- Polyweb

- Posts

- 🕳 🐇 Down the rabbit hole: the Bitcoin and crypto starter guide

🕳 🐇 Down the rabbit hole: the Bitcoin and crypto starter guide

In which we talk about why we need digital currencies, what are the pros and the cons, and we take the plunge in the world of crypto and Bitcoin

✨ Hi, I’m Sara Tortoli and this is the April edition of The Plunge Club, a monthly newsletter dedicated to product and human tinkering.

If you are not a subscriber yet, then take the Plunge and join the Club:

This is the first issue of a new series by the title “🕳 🐇 Down the rabbit hole”, in which I deep dive into different topics. This rabbit hole is dedicated to Bitcoin, and might or might not be one of many more to come on the world of crypto.

🛑 Important: this article is not in any form or shape financial advice. Always do your own research 🛑

A little story

Until recently, I never thought about investing, much less about Bitcoin and crypto. It seemed unnecessarily complicated and time-consuming, something you could not easily access without having a huge amount of money. Then about 7 months into my crazy experiment of productizing my life, something changed. I realized I was not paying enough attention to the way I managed my time and money, two scarce resources with the ability to 10X the quality of my life if administrated correctly.

Inspired by this newfound insight, I was determined to manage my spending differently. That is until after some researches, I found out some interesting facts:

Banks in Germany (where I live) offer a negative interest rate. You pay the bank to keep your money, instead of the other way around. On top of that, traditional german banks have lofty high fees.

Inflation is rising, with Central Banks all over the world printing money to boost shrinking economies in this time of crisis. This means that our savings are losing value faster than any of us would like.

With the current legislation, I will retire aged 67. With the statuary pension, I will receive 51% of my salary, which, with the current inflation rate, won’t be enough for me to live on.

Clearly just cutting expenses wasn’t an option. I needed to start investing. The problem is, I had no idea how. This leads me to switch my researches from savings tactics to investments.

Maybe because I work in tech, or because of the different level of taxation in Germany between stocks and crypto (which at the time of this writing definitely favors the latter), I started falling into the crypto rabbit's hole.

This article is the results of months of researches, the crypto starter guide I wish I had when I began looking into the topic. By the end of this article, you will have the minimum knowledge and resources needed to grasp the concept of digital currencies and Bitcoin.

You can find the link with all the resources and references I used at the end of the article.

What is crypto?

Here is a basic definition to begin understanding Bitcoins and the world of cryptocurrencies:

Cryptocurrencies are digital money. Unlike any other value store assets, like fiat or gold, they don’t have a physical representation. They are the internet's own native currency. Bitcoin is probably the most popular among digital currencies, but there are hundreds of others, known collectively as altcoins. It might come as a surprise, but Bitcoin is not the first attempt to create digital money. Cryptographers have been trying for years to create a digital currency, but no one could quite figure out how to prevent double-spending.

You could simply copy-paste your money, after all, digital money are not guaranteed by any central authority and have anonymous records.

Until in 2008 a paper appeared, published under the pseudonymous of Satoshi Nakamoto. This paper, titled "Bitcoin: A Peer-to-Peer Electronic Cash System" contained the solution to this problem.

But why a digital currency in the first place?

That’s the question I asked myself. As I mentioned, digital currencies are the internet native currencies. They are part of it. Like our Dollar or Euro bills, they can be a way of storing and transferring value, but this where similarities end.

But do we really need another currency?

The fact that paper money predates the internet is significant. Pre-internet, our physical universe was smaller, and the need for long-distance transactions was limited. There was no Amazon or Airbnb or Uber that required digital payments. Paper money worked just fine. With the internet, however, our immediate universe has suddenly expanded. You might be part of a virtual community, with members that live all over the world that you have never physically met. At the same time you might not know your neighbors, which instead you see every day. Our reality, our social interactions, and transactions are not bound anymore by physical proximity. And while the financial system has evolved (e.g. Paypal, Stripes), we still didn’t have a currency that is native to the internet.

Internet democratize and decentralize at the same time. Everyone can participate, no matter where you are, and this is exactly the principle that spurred Bitcoin.

If you think that your credit card or your Paypal account serves the same purpose, that’s not actually the case. Those are just attempts at digitalizing your paper money, to which they are inextricably tied. Furthermore, like paper money, these digital payment providers are also centralized and run by companies owned by a few. You must trust third parties to process transactions and to secure your money. The only way to avoid third parties is currently by paying with cash, but that’s impossible when you cannot connect physically.

This is not the case at all with native digital currencies. There is no “Bitcoin Inc.” and no board of directors to decide, no Bank or Government to ensure legitimacy.

Wait a minute, if there is no “Bitcoin inc.” to run the show, how does it work?

Cryptocurrencies allow to process transactions instantly using a peer-to-peer system. This means that rather than relying on official authorities to maintain and secure the monetary system, like central banks, Bitcoins and all other digital currency rely on people like you and me. Everyone that wants to take part in this system can participate. The condition for generating and maintaining the system is “baked” in the code itself by his anonymous creator(s), Satoshi Nakamoto. The code cannot be changed and is open source.

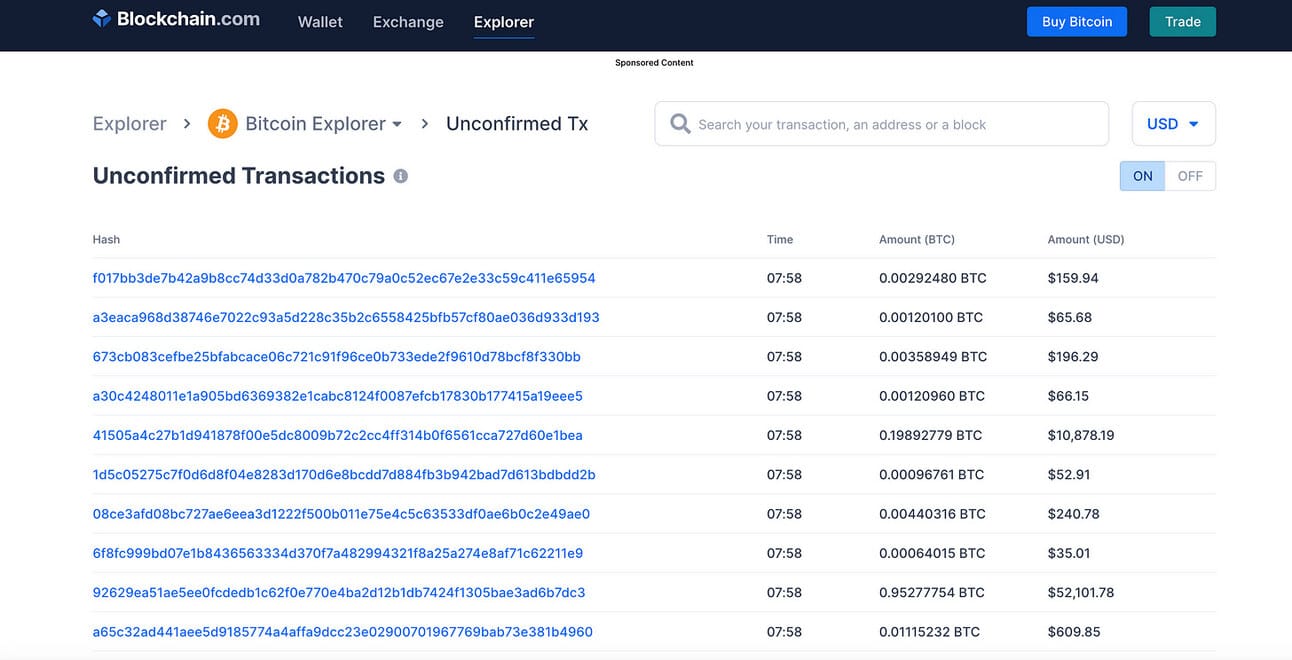

Behind the hood, you can think about Bitcoin as a giant spreadsheet (referred to as ledger). The ledger records all interactions and exchanges that ever occurred since the creation of the first Bitcoin. Everyone can check to verify which transactions have taken place, as well as the amount (see picture below).

The ledger itself is decentralized, meaning there is no one person or company responsible to keep and update our spreadsheet, rather everyone that takes part is responsible. All computers involved store a copy of the ledger.

But how can you rely on a system based on trusting complete strangers with your money, with no one to supervise it?

Here is where it gets more technical. Bitcoin white paper introduced a system to solve this trust issue, that set it apart from all other previous attempts at digitalizing money, called proof-of-work (PoW). In a PoW system, every time that there is a transaction, computers have to solve an encrypted function called a hash function. Hash functions are irreversible and can only be solved by trying out different combinations. It’s like rolling the dices as many times as it is needed until you find the right combination.

The first computer to find the right combination creates a block that is tied to the previous transaction, known as the blockchain. Think of the blockchain as a new way to pass information. Information are “broadcasted” to the blockchain and everyone who is part of the blockchain verify that the information is true. In fact, while the hash function is very difficult to compute, it is very easy for all other computers to check if it’s correct or not once it's solved. All computers in the network check that the function is solved correctly. If that is not the case, the transaction is rejected, otherwise, the computer that solved it first is rewarded by the system with the minting of new coins, a process called mining.

The silent inefficient revolution of Bitcoin

Without going into further details on cryptography and public and private keys, what really stands out is that Bitcoin, with its proof of work system, does something very counterintuitive, against all rules of modern technology. Its secret is to make a system reliable by making it highly inefficient.

It takes tremendous computational power to keep the ledger at scale, and this increases as the network expands. This is why today it is not possible to become a miner simply with your own computer and why Bitcoins negatively impact the planet.

But the fact that everyone in the network needs to check and verify every single transaction, makes the system, however inefficient, trustworthy and resistant to any attack in a way that no central authority can guarantee.

To temper with Bitcoin in fact, you would have to temper with millions of computers spread across the world at the same time. You would have to master all the computational power that ever went into Bitcoin, plus some more, to alter the past transactions.

Why is Bitcoin valuable?

This question has a double answer. The first one relies on beliefs. Contrary to Satoshi Nakamoto vision of Bitcoin as a means of exchange that replaces fiat currency, Bitcoin's buyers are treating it as the equivalent of digital gold. This means that they are buying and holding on to it, instead of using it for paying transactions.

If you are thinking this might be a collective hallucination, one could argue that also gold has no intrinsic value and is a long-term collective hallucination. After all, you cannot eat it, nor it does keep you warm at night. However, at one point in our human history, we have started to believe that gold has intrinsic value, so much so that we started using it as a means of exchange first and as a store of value later.

Since the end of the gold-standard exchange, fiat currencies also have no intrinsic value, as they are made out of paper and are only backed by our collective belief in the governments to enforce their acceptance. We believe that 100$ is actually worth 100$ because everyone else’s believes it, and this belief is enforced by a central government.

Since beliefs get stronger the more widespread they become, and the more sources of credible legitimation they find, Bitcoin is quickly becoming a “legit” store of value.

The second reason that makes Bitcoin valuable, it’s its limited supply. There will ever only be 21,00,000 BTC ever created (currently there are 18,691,931 BTC) and it is estimated that the last Bitcoin will be mined somewhere around 2140. This makes it a scarce good and like all scarce goods, the more the demand, the higher its value (and its price). This explains why Bitcoin is treated as digital gold, with most people holdling instead of trading it.

Bitcoin fact-check ✅

Whether you agree or not with this view of Bitcoin intrinsic value, here are some key facts based on numbers to consider, at the time of this writing :

Bitcoin market cap alone exceeds 1 trillion dollars, about 50% of the entire crypto space. To put into perspective how valuable this is, if Bitcoin was a company, it would be the 6th most valuable company in the world by market cap, surpassing Facebook and almost overtaking Google.

The entire crypto space has a market cap that larger than 2 trillion dollars and is valued more than the most valuable company in the world, Apple.

Large companies are buying Bitcoins and holding them as a store of value. Microstrategy and Tesla are an example.

Financial institutions are buying Bitcoins and investing in crypto projects, like Grayscale

Governments are starting to accept crypto as a new reality and to have encouraging words on Bitcoin. Lately, China has endorsed Bitcoin.

Adoptions and prices are rapidly increasing, causing a positive network effect.

The first crypto company, Coinbase, is officially trading in Wall Street, which is a further consecration for the entire crypto space. Furthermore, you can now buy crypto on Coinbase using Paypal.

The European Investment Bank just announced issuing a 121M$ digital bond, launching on the Ethereum blockchain.

If this is not enough, perhaps the most astonishing fact of all:

Bitcoin is the best-performing asset of the decade, outperforming every other investment asset

Behind the hype: let’s talk risks

Bitcoin has definitely developed a class of its own risks that is unlike any other financial asset. Here are the most common risks to consider before approaching Bitcoins:

Volatility: Bitcoin is not for the faint of hearts. 15-20% drops (or increases) are common, and Bitcoin is the most stable among cryptocurrencies. Last week the price dropped from about 60.000$ to 47.000$

Regulation: some governments have banned (and then unbanned) Bitcoin, making it illegal to purchase it. Also, governments are increasingly looking at this space and we can expect an increase in regulations

Losing your private keys: with freedom comes responsibilities. In the absence of a bank, you become your own bank, which means you are responsible for the security and for storing your Bitcoins (more on this below). If you keep your own wallet and lose your private keys, a long string of passwords to access your wallet, your Bitcoins are lost forever. There is no recovery password.

Environmental risks: due to the computational power required to maintain the blockchain, proof-of-work is not exactly the most eco-friendly system. An article from MIT estimates that it might pump as much CO2 as Kansas City and that was back in 2019.

Before buying: what to ask yourself

Before considering investing in any assets, I have gathered a few questions to illustrate a good thinking process behind investment choices.

What is it you want in your life?

How much money would you need to get to what you want?

Where are you today financially? For example, what is your level of debt, and what are your assets?

Where are you spending your money the most?

If you would have to assign yourself a salary, what is your net worth?

What do you need to make you feel comfortable, your base salary that covers all your expenses?

What are the assets that you are interested in and comfortable investing in? Why?

What is your risk tolerance?

If you need money immediately, what is your exit strategy?

Depending on your answer, you will probably invest in different asset classes. For example, if you have a low-risk tolerance and want a quick exit strategy, or to reap regular profits, then probably ETFs are a more suitable option than Bitcoin.

How to buy and store Bitcoin

There are plenty of options to buy Bitcoins and other cryptocurrencies, and many exchanges to do so. After completing a signup process and the KYC (know your customer) procedures, all it takes to make the first purchase is a bank transfer or your credit card. You can then exchange your fiat money for your crypto of choice. I have tested my fair share of exchanges, and I believe the most beginner-friendly are Coinbase and crypto.com, which also offer the possibility of earning passive interest and requesting a debit card.

One important caveat of buying crypto is that the responsibility of storing and the security of your coins rest entirely on you. When buying Bitcoin, you are "signing" the transaction with your private keys, which identifies you as the sole owner.

Once the transaction is completed and is registered in the blockchain, you have two choices:

Option #1: leave your coins in the exchange where you bought them. Here the exchange owns your private keys and handles them for you. However, keep in mind that those exchanges are not banks and do not ensure your coins. If the exchange gets hacked and your coins get stolen, you are on your own. Furthermore, in periods of panic sell or high traffic, they might delay withdrawals, sometimes even for a few days.

Option #2: store your coins in your own private wallet. There is a saying in crypto: “not your keys, not your coins”. By storing crypto in your own wallet, you become your own bank and you have 100% control of your coins. There are two types of wallets: hot wallets, which can be accessed online through browser and app, and cold wallets. The latter are hardware and offer higher security layers, as they store your crypto offline. This means that it cannot be hacked, but on the other hand you could lose the hardware. If this happens, you could still recover your coins through your private keys. Losing that as well, means that your coins are lost forever.

Final thoughts

Crypto is a fascinating and complex universe. The socio-economical implications of decentralization and democratization are still at the very early stages, and it could potentially change forever our society.

Bitcoin is just the tip of the iceberg. Ethereum and the introduction of smart contracts have even greater transformative powers and a much broader range of applications, in the way not only we exchange values, but in the way, we build companies and create communities. But this is another rabbit hole to explore.

Note: both the Crypto.com and Coinbase links are referral links. By signing up, we both get a monetary reward.

The “Now” section

🎧 What I am listening: the episode of Acquired, dedicated to Bitcoin. It’s a long one, almost 3 hours, but it’s the most comprehensive and accessible guide to Bitcoin history and how it works that I have come across so far.

📚 What I am reading: Poor Charlie’s Almanack which details the thinking processes and investment strategies of Charlie Munger, Warren Buffet's long-time business partner. In investment and life, Charlie advises using mental models to guide your decisions and to take examples from the experience of others as much as possible. I am still going through all of the speeches he gave and find his witty humor and insights compelling. I would advise this volume to anyone that wants to approach investing or opening his/her own company.

🥁 What I am doing: I mentioned at the very beginning that as a result of the experiment I did in productizing my life, I realized that the two elements that could 10X the quality of my life are time and money. While I deep-dived into the money topic, I am now turning my attention to how I can better spend my limited time, which brings a whole lot of interesting and scary thoughts on mortality and how we choose to live our life.

🧐 Question I am asking myself:

How much risk am I willing to take to make it the way I want it?

This question relates not only to investments but also in general to the choices we make in life.